Inflation Pressures Reemerge

The Reserve Bank of Australia kept rates on hold at 3.60%, as inflation pressures began to reemerge. Coupled with stronger-than-expected June quarter economic data, the Australian Dollar rallied against all major currencies.

Chinese authorities halted iron shipments from BHP over an ongoing pricing dispute. Overseas, equity markets continue to hit all-time highs, while bond market activity was more subdued.

Please click here to read our September 2025 markets report as a PDF.

The Advisor Advantage

Having a trusted, long-term financial advisor can make all the difference in navigating the ups and downs of investing. The recent collapses of the Shield Master Fund and First Guardian Master Fund show just how costly it can be without proper guidance—many investors faced serious losses due to concentrated holdings and a lack of oversight. For clarity, LPW has no exposure to these failed schemes.

These events are a clear reminder of why working with reputable advisors and keeping a diversified portfolio is so important for preserving your financial future.

Australian Economy

The Australian economy showed steady growth in the June 2025 quarter, supported by strong household spending and resilient labour market conditions. Quarterly GDP rose 0.6%, while annual growth reached 1.8%, slightly exceeding market expectations.

Household and private discretionary consumption strengthened, boosted by lower interest rates and the timing of public holidays such as Easter and ANZAC Day. As a result, the household saving rate declined to 4.2% from 5.2% in the March 2025 quarter. On a per capita basis, the economy grew 0.2% over the quarter but fell 0.4% over the year, indicating a slight decline in economic output per person over the past 12 months.

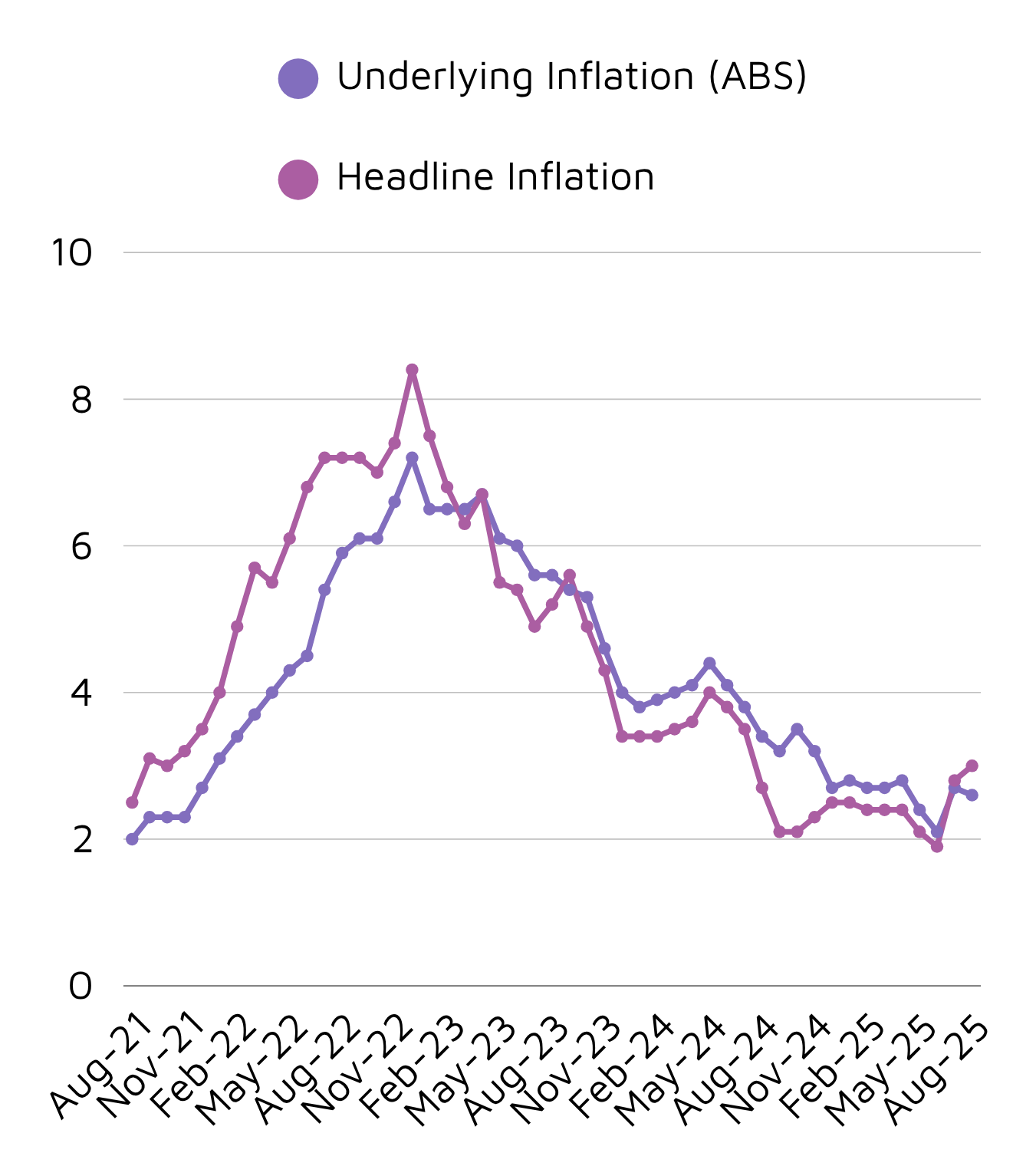

Inflation continues to be stubborn, with the headline consumer price index (CPI) rising to 3.0% and the trimmed mean increasing to 2.6%. While monthly CPI figures are less influential for the central bank than quarterly data, the latest readings suggest inflationary pressures may remain at the upper bound of the RBA’s 2-3% target.

The labour market remained tight, with unemployment steady at 4.2% in August.

In line with market expectations, the Reserve Bank of Australia kept the cash rate on hold at 3.6% at its September meeting. The Board voted unanimously to pause, citing stronger-than-expected GDP growth, a tight labour market, and persistent inflation. During the post-meeting press conference, Governor Michele Bullock indicated that the Board would monitor additional inflation and labour market data before adjusting rates again, while acknowledging that policy remains “a little bit restrictive.”

Source 1: Australian Bureau of Statistics

Markets now expect just one more full 25 basis point cut, with the cash rate settling at 3.30% by the middle of 2026.

Equities

The US market continued to reach new highs, with the S&P 500 rising 3.6% and the NASDAQ climbing 5.7%. Investor optimism was fueled by the artificial intelligence theme and the substantial resources (financial, energy, and data) needed to support emerging technologies. For instance, Oracle projected its cloud infrastructure business to grow 77% to US$18 billion by 2025, reaching US$144 billion by 2030.

The MSCI World index returned 3.3%, while the MSCI Emerging Markets Index jumped 7.1%.

Source 2: JP Morgan

While we are pleased with the strong equity performance in 2025, we remain cautious about future returns. Valuations, particularly in the US, are elevated. Additionally, the effective tariff rate on US imports has risen from 2.5% to over 10% in the past six months, generating roughly US$30 billion per month in tariff revenue. These costs are borne by corporations and could have effects that have yet to fully materialize.

Fixed-Income

Markets were further supported by a 0.25% rate cut from the US Federal Reserve, signaling a more accommodative monetary stance amid moderating inflation pressures. The updated aggregate dot-plot suggests the possibility of two additional rate cuts in 2025 and another in 2026, although wide variations in individual forecasts highlight lingering uncertainty around the future path of policy.

Overall, the Bloomberg Global Aggregate Bond Index finished the month 0.65% higher, reflecting improved investor sentiment toward fixed income assets. In Australia, 10-Year Government bond yields continued to oscillate between 4.2% and 4.4%, ultimately ending the month slightly higher by 2 basis points at 4.30%.

Commodities

September was a mixed month for commodities. Gold surged 11.6%, reaching a record high of US$3,827 per ounce, driven by a softer US Dollar, persistent geopolitical tensions, and growing government deficits, which continued to make it a preferred safe-haven asset.

Iron ore prices rose 2.0% following a resolution of the pricing dispute between BHP and Chinese authorities. While the disagreement should be resolved, it does raise broader geopolitical concerns regarding Australia’s number one export. Agricultural commodities, including wheat and soybeans, experienced declines over the month.

Currencies

The Australian Dollar extended its recent rally, recording the strongest gains among G10 currencies in September. Robust GDP data and the possibility of a resurgence in inflation supported demand for the local currency, as investors sought higher yields amid expectations of potential interest rate increases.

At the same time, the US Federal Reserve’s rate cut provided an additional tailwind for the AUD, helping it reach an 11-month high of $0.66 against the US Dollar.

General Advice Disclaimer: The information and opinions within this document are of a general nature only and do not consider the particular needs or individual circumstances of investors. The Material does not constitute any investment recommendation or advice, nor does it constitute legal or taxation advice. Zuppe International Pty Ltd (ABN 12 628 405 952)

(The Licensee) does not give any warranty, whether express or implied, as to the accuracy, reliability or otherwise of the information and opinions contained herein and to the maximum extent permissible by law, accepts no liability in contract, tort (including negligence) or otherwise for any loss or damages suffered as a result of reliance on such information or opinions.

The Licensee does not endorse any third parties that may have provided information included in the Material. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Therefore, any stated figures should not be relied upon. The investment return and principal value of an investment will fluctuate so that an investor’s investments, when redeemed, may be worth more or less than their original cost.