Markets Defy Uncertainty in 2025

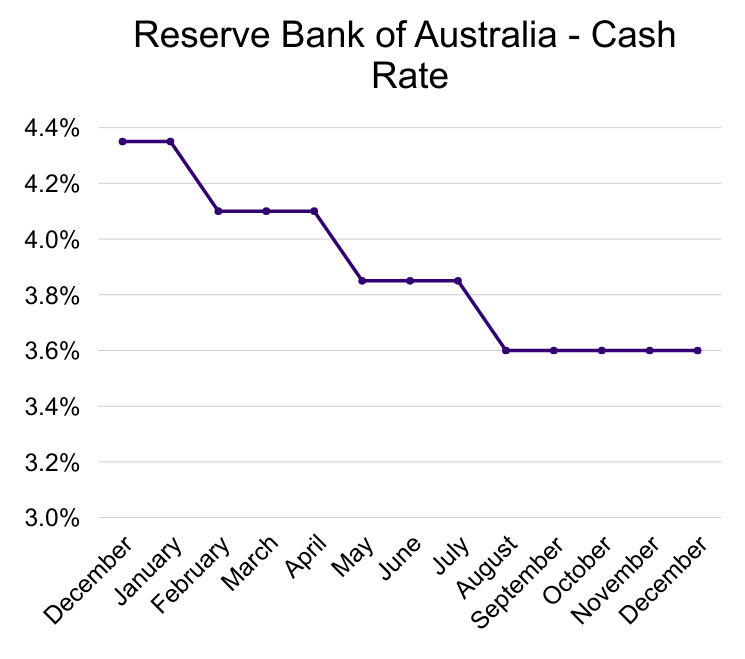

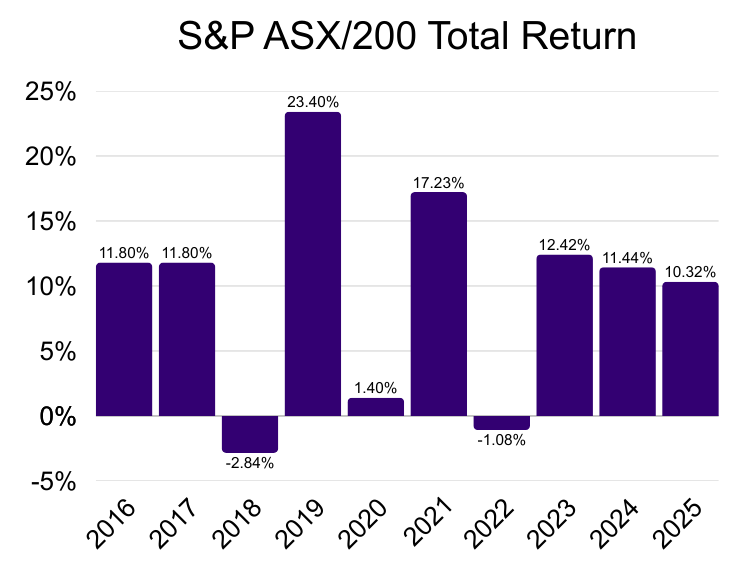

Despite the geopolitical and trade headwinds, both equities and bonds delivered positive returns for diversified investors in 2025. The Reserve Bank of Australia kept the cash rate steady at 3.60%, signalling that the next policy move is likely to be higher. Strong performance from mining stocks helped lift the ASX to a third consecutive year of double-digit gains. Toward the year-end, domestic bond yields broke higher as expectations for further rate cuts diminished.

Please click here to read our December 2025 markets report as a PDF.

Asset classes including equities, bonds and commodities delivered positive returns in 2025, despite persistent headwinds from trade tensions and inflationary pressures. The year once again underscored the importance of broad diversification across asset classes and geographies.

Both Australia and the United States recorded admirable returns. However, the strongest performers were less discussed regions such as Japan, China and emerging markets. This is why we advocate for broad exposure in our portfolios, ensuring investors are well positioned to navigate both market uncertainty and return opportunities.

Australian Economy

The Reserve Bank of Australia voted unanimously to keep the cash rate on hold 3.60%, with recent data suggesting inflation pressures “have tilted to the upside”. A rate cut was not considered at the meeting, signalling that easing is unlikely in the near term.

This decision was reinforced by the release of the November monthly headline inflation data, which came in at 3.4%. That followed the September quarter CPI print of 3.2%, which exceeded forecasts.

The Australian Bureau of Statistics will now publish complete inflation data on a monthly rather than quarterly basis. While this should support more timely policy decision-making, it may also increase market volatility as investors respond more rapidly to incoming data.

Data Source: Reserve Bank of Australia

Labour market conditions remain tight. Unemployment rate fell to 4.3% after rising to 4.4% in November. While unemployment has been creeping higher, it remains well below the pre-pandemic average of 5–6%.

Economic growth increased to 2.1% in the September quarter, although quarterly growth of 0.4% fell short of expectations. Interestingly, unit labour costs declined, suggesting inflation pressures are not solely driven by wages.

However Governor Michele Bullock highlighted limited spare capacity in the economy, citing low labour underutilisation and ongoing difficulties for firms in sourcing workers.

Equities

The S&P/ASX 200 rose 1.2% in December, despite a shift in interest rate sentiment and higher bond yields. Materials stocks led the gains, advancing 6.6% over the month, while technology companies continued their recent pullback, declining 8.7%.

This sector performance was broadly reflective of 2025 as a whole. Materials were the standout, rising 31.7% for the year, driven by strong gains in precious metals. In contrast, healthcare and technology stocks struggled, with both sectors declining over 20%.

After starting the year on a tear and exceeding $190 in June, Commonwealth Bank shares fell to finish only 5% higher in 2025. The financials sector finished the year 8.0% higher.

Overall, the local benchmark finished 2025 up 6.2% to 8,714 points. Including dividends, the index delivered a total return of 10.3%, marking its third consecutive year of double-digit gains.

Data Source: S&P Global

The MSCI World Index climbed 21.1%, supported by broad-based returns across regions. The S&P 500 posted a 17.9% total return, while the tech-heavy NASDAQ 100 recorded a 21.0% gain.

While artificial intelligence dominated headlines, only two of the so-called “Magnificent Seven” outperformed the broader market in 2025—NVIDIA and Alphabet (Google).

Excluding Tesla, valuations remained largely unchanged with earnings growth the primary driver of investor returns. This points to a healthier market, despite headlines warning of an artificial intelligence bubble.

Gains outside the US attracted less attention but were equally notable. The Euro Stoxx Index rose 16.7%, while Japan’s Nikkei 225 delivered a 26.2% gain. Emerging markets also performed strongly, with the MSCI Emerging Markets Index advancing 33.6%, led by China and Taiwan amid easing trade tensions and a weaker US dollar.

Fixed Income

Local bond yields rose sharply in December as market expectations shifted in response to lingering inflation. Australian and Japanese 10-year government bond yields each increased by 25 basis points. Even US Treasury yields rose 15 basis points, despite the US Federal Reserve delivering its third consecutive interest rate cut.

At the start of the year, investors had priced in 100 basis points of rate cuts—three in 2025 and one more in 2026. The RBA did cut three times this year, but expectations have now swung toward a potential rate increase in 2026 rather than further easing.

The adjustment was slow to materialise through most of the year, with Australian 10-year government bond yields trading in a narrow range between 4.1% and 4.5%. However, yields broke decisively higher toward year-end, finishing 2025 at 4.75% - a positive for investors seeking reliable income.

Despite the weakness in December, bonds still delivered positive returns for the full year. The Bloomberg AusBond Composite Index closed 2025 up 3.2%, while the Bloomberg Global Aggregate Bond Index finished 4.4% higher in Australian dollar terms.

Currencies

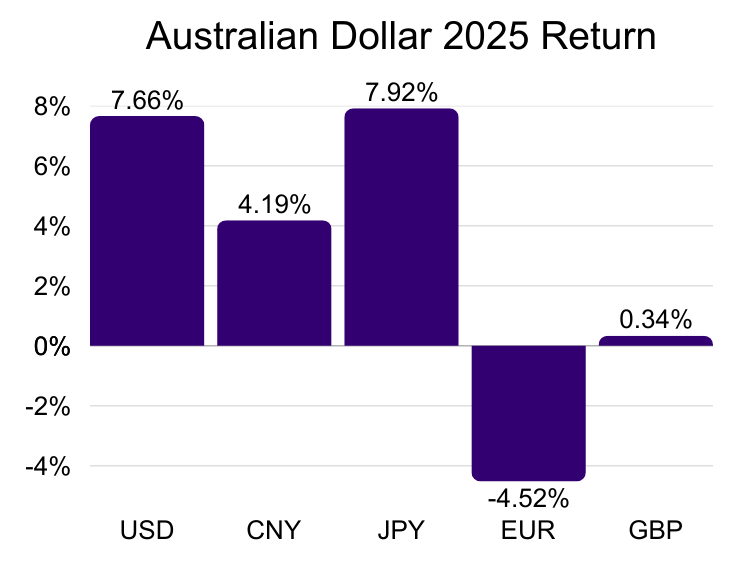

The Australian dollar gained ground against major currencies in December, buoyed by expectations of cash rate hikes in the year ahead.

Overall, the local currency delivered a strong performance in 2025 despite a slow start. Elevated commodity prices, together with interest rates remaining higher than anticipated, made the AUD relatively attractive. This strength was further supported by a weaker US dollar, which fell against most major currencies.

Data Source: Reserve Bank of Australia

Commodities

Precious metals were the standout performers in 2025. Gold surged 67% as investors and central banks sought greater portfolio diversification amid geopolitical risks and expectations of central bank rate cuts.

Silver followed later in the year, ending 145% higher, driven by structural supply shortages and robust industrial demand linked to the green economy. Copper also posted solid gains, supported by tight supply conditions and rising demand from electrification and renewable energy sectors.

In contrast, oil prices retreated 18.5% over the year, weighed down by excess supply and subdued global demand. Iron Ore was volatile throughout, but ultimately landed 6.2% higher.

General Advice Disclaimer: The information and opinions within this document are of a general nature only and do not consider the particular needs or individual circumstances of investors. The Material does not constitute any investment recommendation or advice, nor does it constitute legal or taxation advice. Zuppe International Pty Ltd (ABN 12 628 405 952)

(The Licensee) does not give any warranty, whether express or implied, as to the accuracy, reliability or otherwise of the information and opinions contained herein and to the maximum extent permissible by law, accepts no liability in contract, tort (including negligence) or otherwise for any loss or damages suffered as a result of reliance on such information or opinions.

The Licensee does not endorse any third parties that may have provided information included in the Material. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Therefore, any stated figures should not be relied upon. The investment return and principal value of an investment will fluctuate so that an investor’s investments, when redeemed, may be worth more or less than their original cost.