Tariffs Fade, Inflation Stays

In many respects, the start of 2026 has mirrored the beginning of 2025, with market sentiment once again dictated by US trade policy.

Instead of tariffs on neighbouring Mexico and Canada, the crosshairs were aimed at Europe following renewed rhetoric regarding potential US ownership of Greenland.

Although the tariff threat was ultimately withdrawn after a framework agreement, it reinforced investor concerns about policy uncertainty and the reliability of the US as a stabilising global force.

This has supported the continuation of the US dollar debasement trade, with commodities and other safe-haven currencies strengthening.

In the coming months however, the effectiveness of tariff threats as a policy tool may diminish.

Key Points:

The Reserve Bank of Australia is expected to raise rates by 25 basis points as inflation remains persistent

The use of tariffs as a negotiating tool may become less effective, potentially introducing new sources of market uncertainty

A commodity rally and US dollar weakness have pushed the Australian dollar above US$0.70

As a result, the administration may adopt alternative policy approaches, introducing fresh sources of uncertainty as it recalibrates its negotiating toolkit.

Closer to home, inflation remains the central economic concern. A year ago, market commentary focused on the possibility of a 25-basis-point rate cut. This year, it’s likely the central bank will raise 25 basis points on February 3.

Please click here to read our January 2026 markets report as a PDF.

Australian Economy

Inflation came in at 3.8% in December, marking the fifth consecutive month above the RBA’s target range. Trimmed mean inflation has also remained persistently elevated, hovering just above the upper bound of the 2–3% target band throughout much of the past year.

It’s likely the central bank will be forced to course correct and raise interest rates by 25 basis points on February 3.

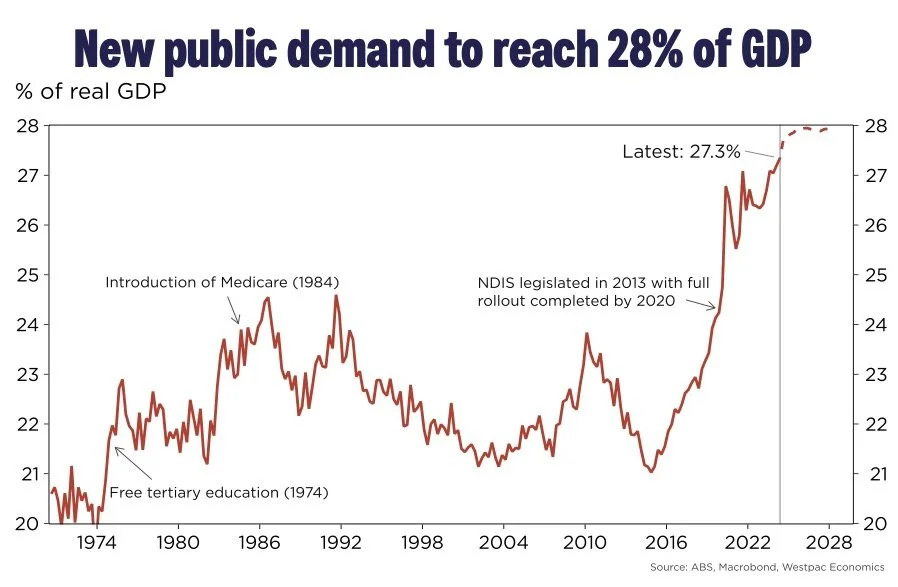

Much of the public commentary links inflationary pressures with record-high government spending. While that is undoubtedly a contributor, the lion’s share of blame lies with supply-side policy rather than spending decisions.

Source: Westpac

For example, the inability to build enough homes places upward pressure on rents, which rose 3.9% over the past year. Moreover, capital city dwelling prices jumped 9.2%. Energy is another area of concern, with planning bottlenecks strangling investment in new projects. Subsequently, electricity costs have increased 4.6% over the same period.

More broadly, the country faces a persistent productivity problem. Although unemployment is historically low at 4.1%, GDP per capita is negative, meaning living standards will decline over the long-term.

While curbing government spending might offer short-term relief, a lasting solution requires addressing structural shortages in housing, infrastructure, and skilled labour.

Equities

The S&P/ASX 200 began the year positively, rising 1.7% in January. Strength in commodity prices supported the resources sector, with materials gaining 9.5% and energy rising 10.6%. In contrast, investor sentiment toward the technology sector remained weak, with valuations continuing to retrace following prior highs.

Internationally, the S&P 500 advanced 1.5%, supported by small-cap strength and a rotation away from technology leaders. The MSCI Asia ex-Japan Index surged 8.6%, driven by renewed enthusiasm for semiconductor and artificial intelligence-related companies, particularly in South Korea and Taiwan. A weaker US dollar also supported regional returns. Japanese equities rose 4.6%, while European markets posted moderate gains.

Fixed Income

Local yields continued to climb as markets gained confidence in a rate hike by the Reserve Bank of Australia. Australian 10-year government bond yields increased by 6 basis points, while the 3-year equivalent rose by 14 basis points.

Overseas, Japanese bonds were the primary focus. Yields moved significantly following the announcement of a snap election scheduled for February 8. This shift was driven by expectations of fiscal expansion (tax cuts, increased spending) coupled with signals from the Bank of Japan regarding future rate hikes to combat inflation.

Currencies

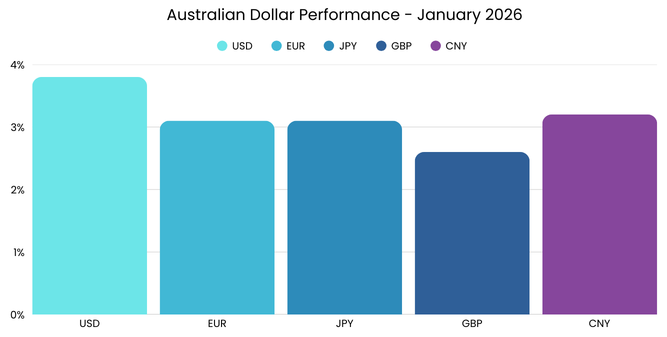

The Australian dollar delivered another strong month, with the trade-weighted index reaching its highest level in over four years. Persistent domestic inflation and resilient employment have reinforced expectations that Australian interest rates will remain relatively elevated, increasing the currency’s attractiveness to yield-seeking investors.

Data Source: NSW Treasury Corporation

While US trade policy has had muted impact on equity and bond markets, currency markets have responded more visibly. The US Dollar fell against all G10 countries. Against this backdrop, the Australian dollar rose above US$0.70 for the first time since 2023.

Commodities

Commodities remain in a sustained bull phase, marked by a sixth monthly rise in the RBA Commodity Price Index. While Copper hit record highs and Lithium reached a two-year peak, Iron Ore bucked the trend, falling 3.6%. Oil prices surged 14.2%, rebounding on geopolitical tensions and civil unrest in Iran.

Although precious metals are being classified as “safe havens”, investors should recall that both remain volatile and cyclical in nature. This sensitivity was clear late in the month, with both Gold and Silver falling after Kevin Warsh was appointed Fed Chair as markets priced in a more dovish shift in US monetary policy.

General Advice Disclaimer: The information and opinions within this document are of a general nature only and do not consider the particular needs or individual circumstances of investors. The Material does not constitute any investment recommendation or advice, nor does it constitute legal or taxation advice. Zuppe International Pty Ltd (ABN 12 628 405 952)

(The Licensee) does not give any warranty, whether express or implied, as to the accuracy, reliability or otherwise of the information and opinions contained herein and to the maximum extent permissible by law, accepts no liability in contract, tort (including negligence) or otherwise for any loss or damages suffered as a result of reliance on such information or opinions.

The Licensee does not endorse any third parties that may have provided information included in the Material. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Therefore, any stated figures should not be relied upon. The investment return and principal value of an investment will fluctuate so that an investor’s investments, when redeemed, may be worth more or less than their original cost.